capital gains tax increase uk

The capital gains tax allowance is the amount of profit you can make from the sale of an asset before you have to pay capital gains tax. First published on Sun 6 Nov 2022 1326 EST.

The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax and for good reasons.

. This means youll pay 30 in Capital Gains. The current capital gains tax allowance is. The finance minister is reviewing changes to the headline rate reliefs and allowances on CGT while also considering hitting savers with an increase in dividend taxes the.

Capital Gains Tax. At the moment CGT is charged at four rates. Capital Gains Tax rates in the UK for 202223.

10 18 for residential property for your entire capital gain if your overall annual income is below 50270. You also do not have to pay. Chancellor of the Exchequer Jeremy Hunt is considering increasing the headline rate of capital gains tax as he and Prime Minister Rishi Sunak seek ways to plug the.

Mr Hunt is looking at raising the dividend tax rate and a cut to the tax-free dividend allowance in a 1bn-a-year tax raid on pensioners business owners and the self-employed. With inflation high Hunt plans to keep tax-free thresholds at the same level for various levies including those on income pensions and capital gains to expand the states tax haul by billions. 20 for trustees or for personal representatives of someone who has died not including.

Back in 2020 when Rishi Sunak was Chancellor he commissioned a report from the Office for Tax Simplification which suggested the current maximum CGT rate of 28 per. Prior to this capital gains were not taxed. 18 and 28 tax rates for individuals for residential property and carried interest.

Channon observed that one of the primary. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. The newspaper also suggested the Chancellor is looking at increasing dividend taxes and halving or even slashing altogether the 2000 tax-free dividend allowance.

Or could the tax rate be retroactively applied to the 202122 tax year. Jeremy Hunt will set out tax rises and spending cuts totalling 60bn at the autumn statement under current plans including at. Some assets are tax-free.

Basic rate taxpayers would also see bills increase from 18 to 20. 2 minute read November 3 2022 1106 PM UTC Last Updated ago UK considers cutting tax-free dividend allowance increasing capital gains tax -media. The tax is currently paid at a 40 percent rate on anything over 325000 this threshold will be frozen until 2026 as announced by Mr Sunak in the March Budget.

For example if you bought a painting for 5000 and sold it later for 25000 youve made a gain of 20000 25000 minus 5000. If the two taxes had the same rates higher rate taxpayers would see CGT bills rise from 28 to 40. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. Rise in capital gains tax on the cards as Chancellor Hunt scrambles to raise 50bn. With such a big.

Although capital gains tax CGT is not a big revenue raiser for the government the rates of CGT have remained the same since 6 April 2017. The rate is 10 for basic rate taxpayers on gains except those on the sale of residential property where the rate is 18. The capital gains tax CGT system was introduced by Labour Chancellor James Callaghan in 1965.

As the Chancellor is weighing up difficult decisions to address a 50bn black hole in.

What Does The Uk Budget Hold For Sterling Action Forex

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Founders Warn They Ll Be Sucked Dry By Uk Tax Rise

Times Faceoff Both Us And Uk Are Planning To Hike Capital Gains Tax Should We Use Revenue To Cut Steep Duties On Fuel Times Of India

5 Potential Tax Changes That Could Help Pay The Coronavirus Debt

Official Report Recommends Significant Increases In Capital Gains Tax Thompson Wright

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Definition Rules Taxes And Asset Types

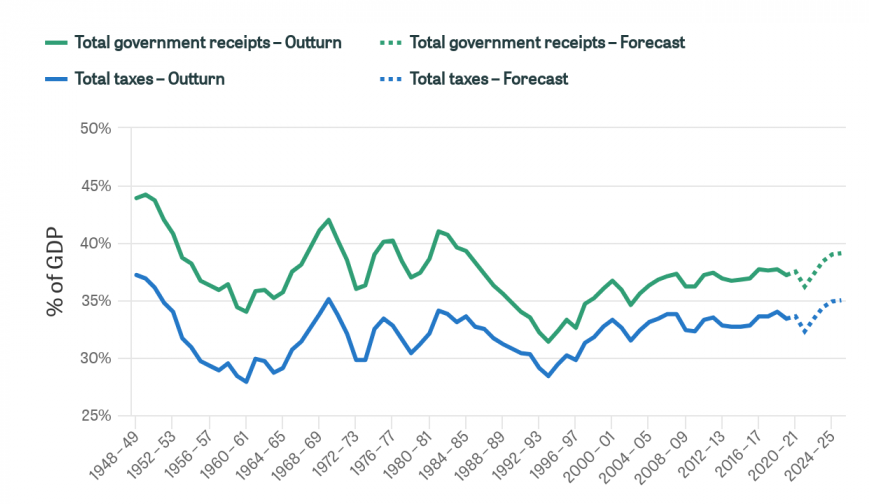

How Have Government Revenues Changed Over Time Institute For Fiscal Studies

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

Capital Gains Tax Rises To 28 For Higher Earners Budget The Guardian

2021 Capital Gains Tax Rates In Europe Tax Foundation

U S Taxpayers Face The 6th Highest Top Marginal Capital Gains Tax Rate In The Oecd Tax Foundation

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

What Is Capital Gains Tax Jeremy Hunt Considers Rise In Capital Gains Tax To Fix 50 Billion Hole The Scotsman

How Are Capital Gains Taxed Tax Policy Center

Rishi Sunak Orders Review Of Capital Gains Tax Amid Fears Of Rate Increase